Researching whether a college will close

For most colleges and universities, competing for high school seniors has been a cutthroat Hunger Games exercise for many years.

Before the pandemic hit, the majority of colleges were failing to meet their freshmen admission goals every year.

At the start of the pandemic, some respected higher-ed observers predicted that many colleges would close by the summer, but that hasn’t happened.

So far, most schools are still open for business. Whether this will last, remains an open question.

Whatever happens, it makes sense to do your own research on whether colleges on your child’s list are financially stable.

Resources to evaluate a college’s financial health

To help you with that task, I’m sharing some new and old resources that attempt to divine how financially secure a higher-ed institution is. Here are the resources that you should consider checking out:

No. 1:

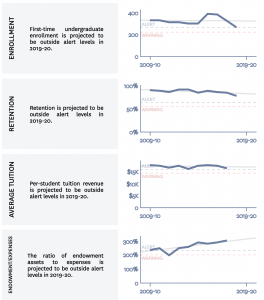

Hechinger Report, a higher-ed nonprofit news operation, recently released its Financial Fitness Tracker. The tracker shares the results of its financial stability analysis of 2,662 private and public four-year and two-year colleges and universities by examining key metrics including enrollment, tuition revenue, public funding and endowment health.

Among the information you will get for each school is a chart (see sample below) that breaks down an institution’s trends for enrollment, retention, average tuition and ratio of endowment and expenses.

No. 2:

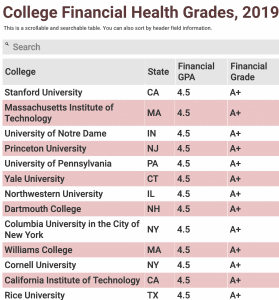

Another good tool to evaluate a college’s financial strength is through an annual report that Forbes produces called the College Financial Health Grades.

You can use the built-in search function in the online report to discover the financial grade of 933 college or university. The best grade is an A+ and D is the worst.

The report only covers private, non-profit institutions and not public ones.

It should be noted that while state universities have and will continue to experience troubles, they do have support from their own state governments (even if it’s woefully inadequate and almost certainly will be), which is a luxury that private institutions don’t enjoy.

The latest health grades tool was released in November 2019 so I hope an update will be coming soon!

Here is a screenshot of the schools at the top of the Forbes report card:

No. 3:

College Financial Health Center from Edmit, an admissions resources for families, is another tool to check the financial viability of 937 private colleges and universities. It shares a school’s endowment and its endowment per student and also shares the Forbes Financial

Health Grade and the financial responsibility score from the U.S. Department of Education. Edmit is actually a handy tool to research important statistics about individual schools including:

- Average merit scholarships.

- Percentage receiving merit scholarships.

- Average net price.

- Average percentage of need met.

- Percent receiving aid.

Here is a screenshot of what you’ll find at Edmits:

No. 4:

Scott Galloway, a serial entrepreneur and a larger-the-life marketing professor at New York University, has been a thorn in the side of the higher-ed industry for years. Undeterred by conventional wisdom and sacred cows, Galloway doesn’t hold back with his opinions of the higher-ed industry. And it is an industry.

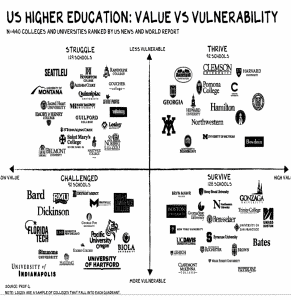

Galloway says a reckoning is coming with overpriced schools, bloated administrations and hidebound ways. Galloway received considerable press when he suggested in his recent higher-ed analysis that roughly 90 colleges could perish due to the pandemic.

Here is the link to his value vs. vulnerability spreadsheet on 442 undergraduate institutions. He gave each schools two scores. The value-to-cost ratio seeks to quantify each school’s value relative to its tuition cost and the vulnerability score seeks to quantify a school’s vulnerability to COVID-19.

In his gloom-and-doom analysis, which has yet to come to fruition, he places schools in four categories:

Thrive. Elite schools and those that offer strong value have an opportunity to emerge stronger as they consolidate the market, double down on exclusivity, and/or embrace big and small tech to increase the value via a decrease in cost per student.

Survive: Schools that will see demand destruction and lower revenue, but will be fine, as they have the brand equity, credential-to-cost ratio, and/or endowments to weather the storm.

Struggle: Tier-2 schools with one or more comorbidities, such as high admit rates (anemic waiting lists), high tuition or scant endowments.

Challenged: This last category Galloway had originally named “perish.” There was such a strong blowback to predicting that schools in this lowest category could disappear or merge that he changed the description to “Challenged.” He said this group has high admittance rates, high tuition, low endowments, dependence on international students and a weak brand equity.

In the following chart, you will see some of the schools that Galloway placed in each of the four categories:

Become a smart college consumer:

The only way to make the smartest college decisions is to become an empowered college shopper. The easiest way to do that is to enroll in my popular online course: The College Cost Lab.

Learn more about the invaluable course that will help you potentially save tens of thousands of dollars or much more and find wonderful schools here.

Published at Mon, 12 Oct 2020 20:51:20 +0000

Article source: https://www.thecollegesolution.com/researching-whether-a-college-will-close/